From Zero to Launch: A B2B Payment Platform for Small Businesses

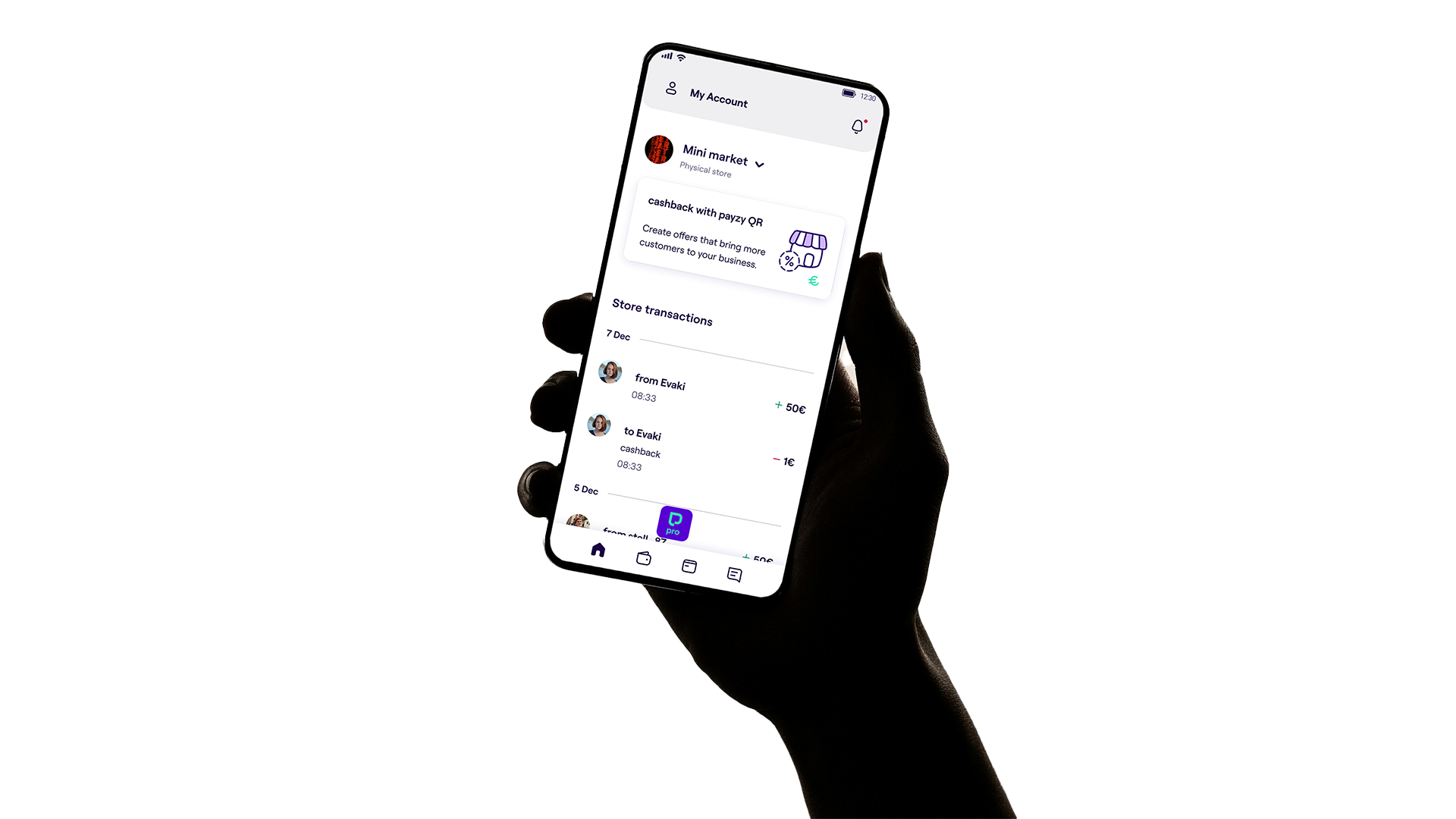

How I led the UX for a B2B app that enables small businesses in Greece to accept payments, run rewards, and manage their store through a unified, accessible experience.

Role

UX Lead

Platform

payzy pro (iOS, Android), Onboarding (Web)

Timeline

2024

Context & My Role

payzy Pro is a mobile-first ecosystem that turns smartphones and tablets into payment terminals, enabling small businesses to accept QR and card payments while promoting their shops through built-in cashback and promotional tools. When I joined, the B2B offering was at the ideation stage, an extension of the existing consumer app, but without defined UX foundations, merchant journeys, or service flows.

As Senior UX Designer and UX Lead for the B2B initiative, I owned the end‑to‑end experience: from shaping the product vision and experience principles to defining user types, mapping service flows, and designing core interactions. I led cross‑functional collaboration with Product, Engineering, Compliance, and Marketing, aligning business goals and regulatory constraints with a clear, user‑centred strategy for small and medium‑sized merchants.

Problem

Small and micro businesses lacked an affordable, low‑friction way to accept digital payments, often relying on expensive POS hardware, high commissions, and delayed settlements that hurt already thin margins. For COSMOTE, this meant a missed opportunity to serve a fast‑growing segment with a mobile‑first solution that combined payment acceptance, instant liquidity, and simple merchant growth tools like listings and cashback.

From a UX perspective, existing payment experiences were fragmented across multiple systems, opaque about fees and settlement timing, and difficult for non‑technical merchants to set up and trust. Journeys between consumer and merchant experiences were disconnected, accessibility was inconsistent, and owners had little visibility into performance beyond raw transaction logs.

If nothing changed, COSMOTE risked losing small‑business market share to more agile fintech competitors, weakening brand trust in its fintech ambitions, and missing a meaningful revenue stream from merchant services.

For merchants

Expensive POS hardware and high fees

Slow access to funds and paper-based processes.

Fragmented tools for payments, promotion, and reporting

For the business

Missed the SME segment in digital payments.

Risk of losing merchants to existing soft‑POS competitors.

Need to prove fintech credibility.

What I did

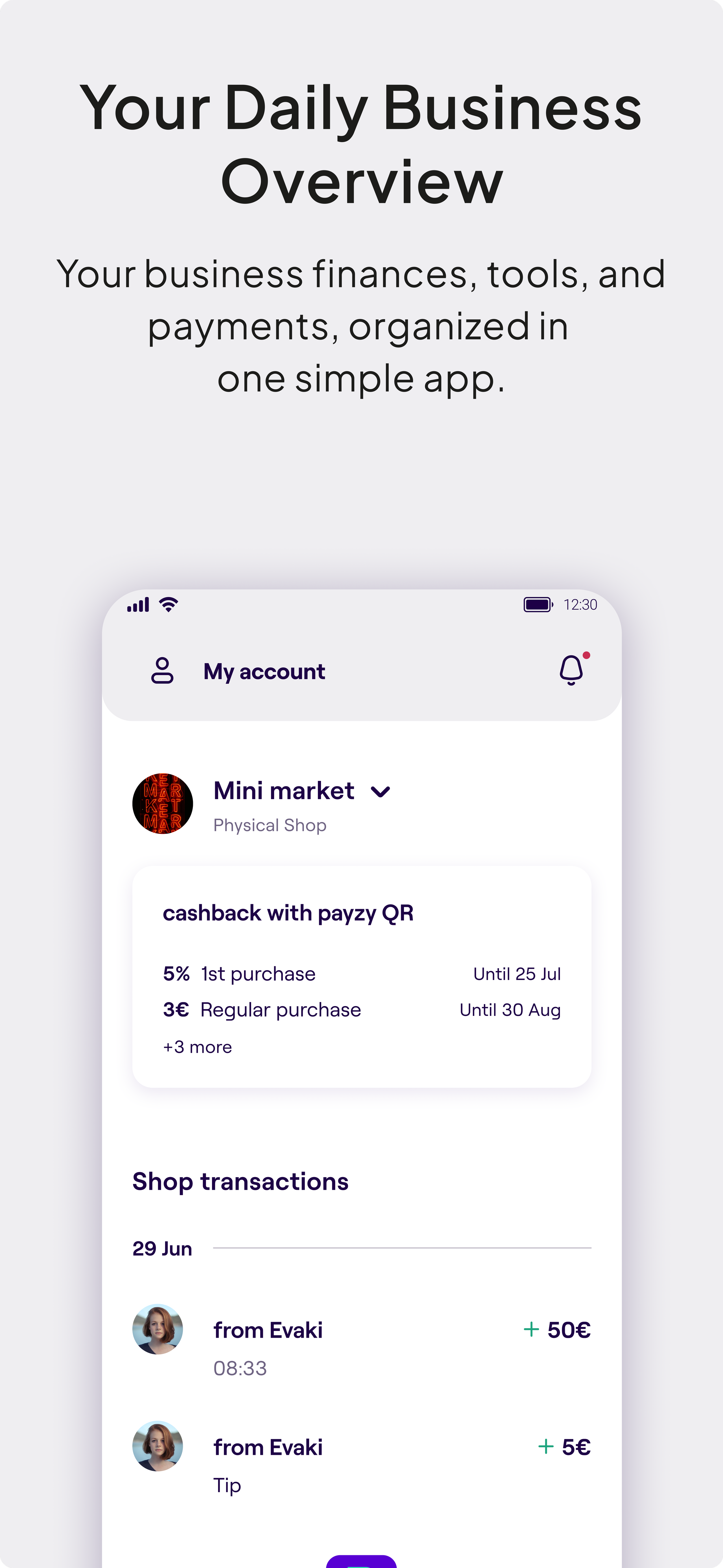

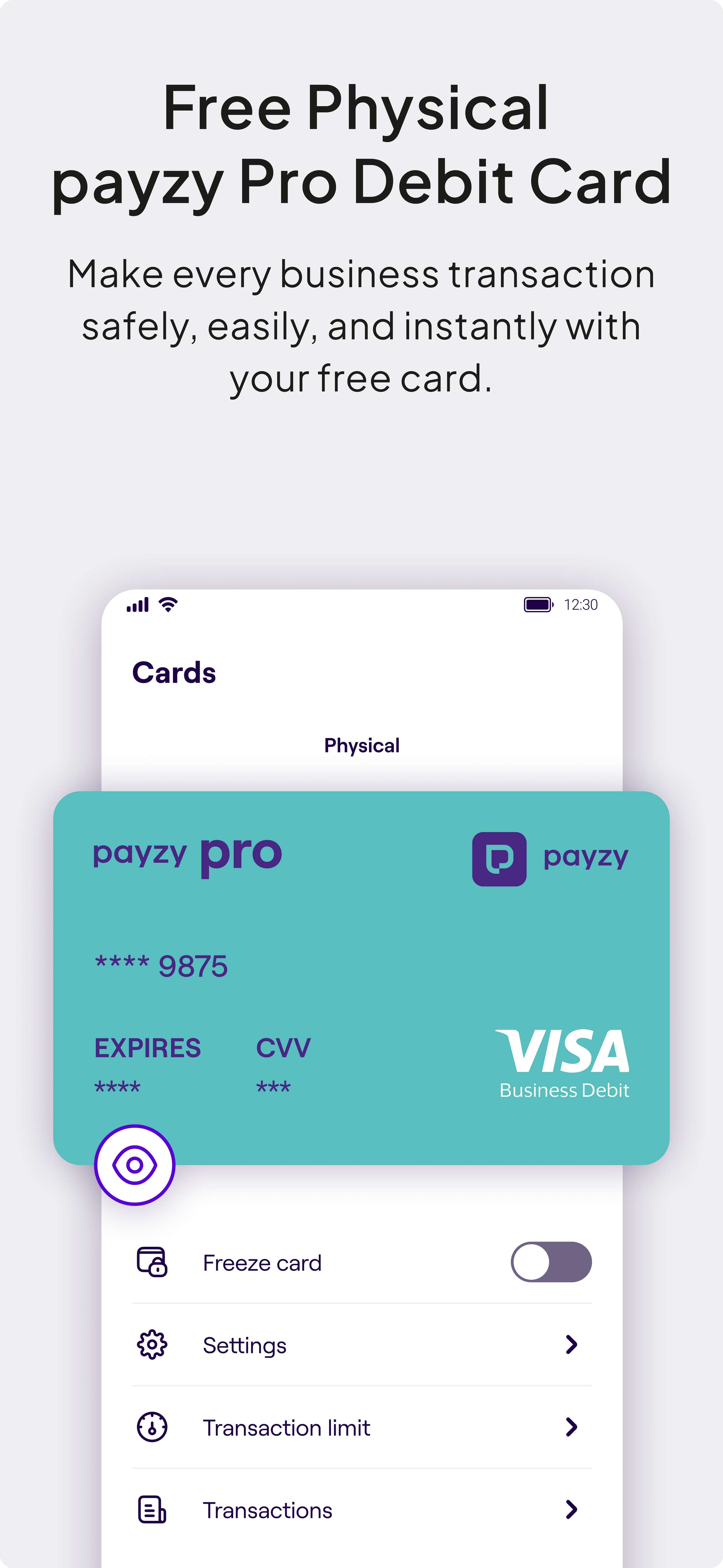

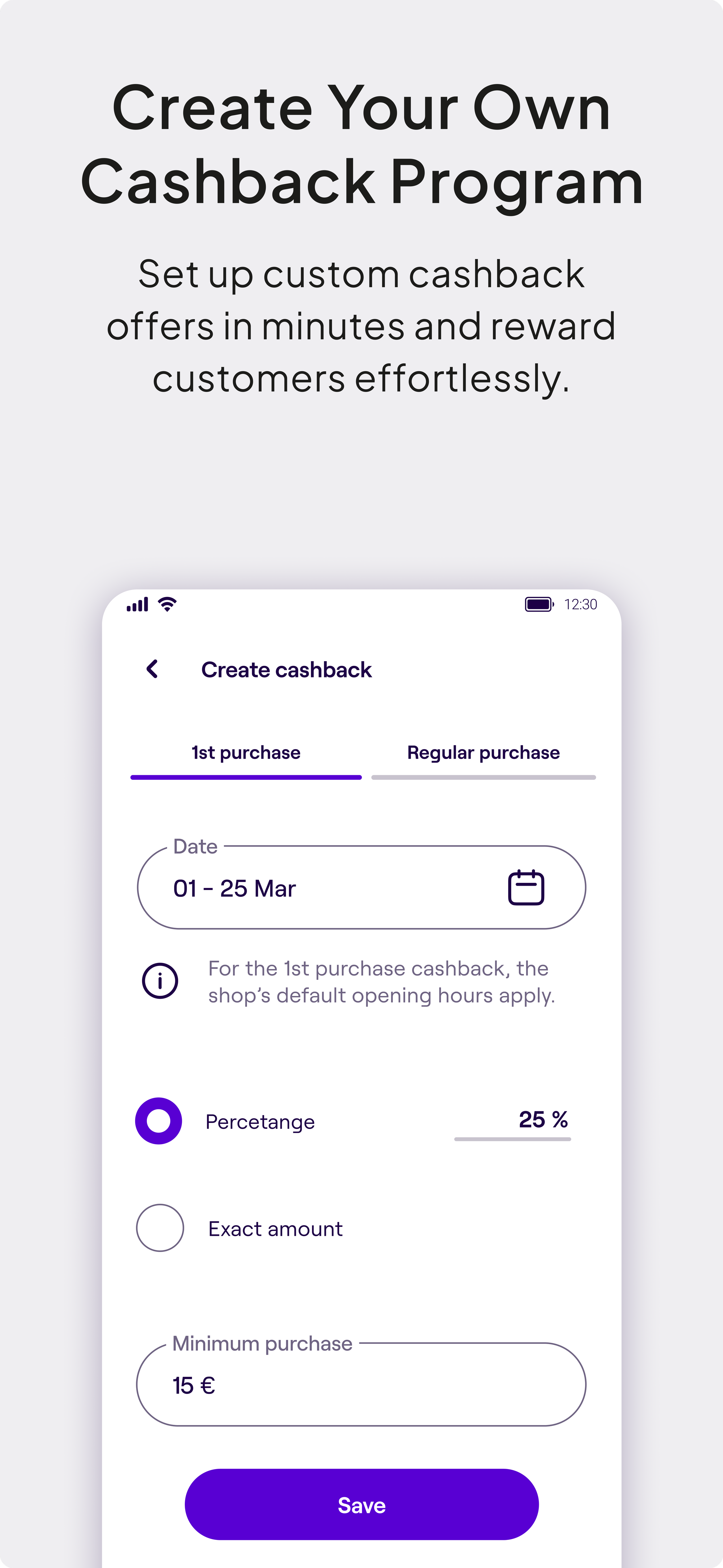

To steer the product, I defined a set of experience principles: mobile‑first access for merchants using only their phones or tablets, a single, streamlined flow to “get paid” with minimal steps, radical transparency around fees and settlement timing, accessibility by default for varying digital literacy levels, and integrated business support so payments, promotion, and insights lived in one place.

I led discovery through cross‑functional workshops, end‑to‑end journey mapping, service blueprinting, competitive analysis, and synthesis of external merchant research, translating findings into concrete UX requirements and product priorities. As UX Lead, I owned the information architecture, core app flows (onboarding, card and QR acceptance, history and reporting, rewards management, notifications), and the adaptation of the existing design system for B2B, continually simplifying interactions to reduce friction and build trust.

Beyond design execution, I drove alignment across Product, Engineering, Compliance, Marketing, and Operations, set up recurring UX rituals and review cadences, mentored designers, championed accessibility and usability standards, and partnered with product and analytics to define KPIs for merchant adoption, transaction success, and satisfaction—using these metrics to influence roadmap and validate UX decisions.

Solution

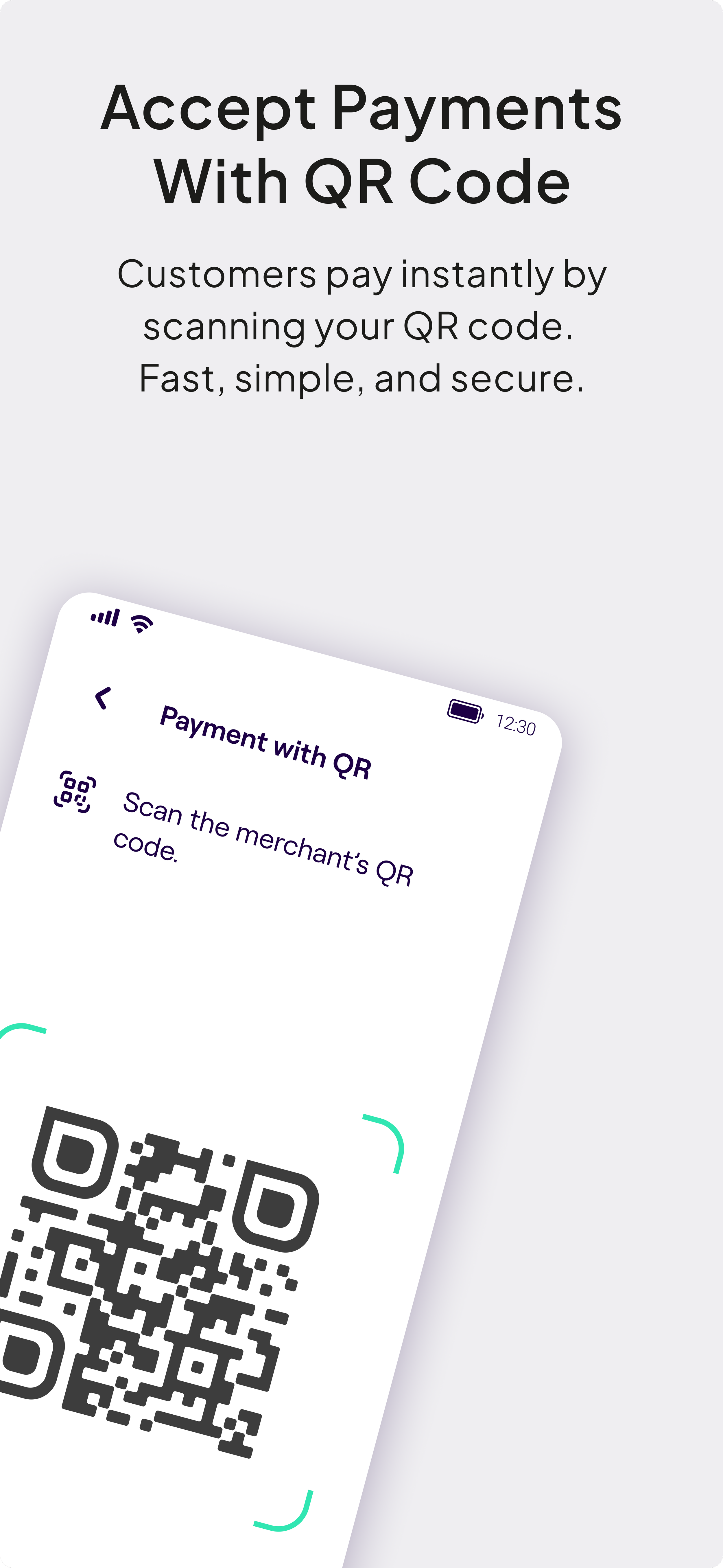

The initial release focused on three hero flows: accepting payments via QR, setting up cashback and loyalty programmes, and managing store profiles directly from the app. Merchants moved from cash and complex terminals to instant, mobile‑based QR payments; from manual or third‑party promotion tracking to built‑in rewards; and from paper forms or scattered admin tools to simple, in‑app control over business details and settings.

For COSMOTE, this mobile‑first experience reduced acquisition friction, lowered support load through clearer self‑service flows, and created a foundation of integrated data across transactions, promotions, and merchant profiles that supports future markets and features. In the portfolio, the story can be illustrated safely with three abstracted visuals: a QR payment screen as the core “get paid” moment, a step‑by‑step cashback setup flow, and a store profile/merchant overview screen showing how everything stays manageable in one place.

Outcomes

The launch of the merchant app led to hundreds of sign‑ups within the first months, with double‑digit growth in new merchants month over month and a steady rise in active merchants regularly using QR payments. Merchant transaction volume grew significantly, with many businesses processing multiple payments per day and early adopters using cashback to drive repeat visits.

Onboarding time dropped from hours of paperwork to a fully digital flow that could be completed in minutes, and clearer, self‑service flows contributed to a noticeable reduction in support tickets. Qualitative feedback indicated that merchants found the experience simpler and faster, with higher confidence in using digital payments for everyday business.

Internally, the project helped establish regular UX rituals, from structured design reviews to cross‑team alignment sessions, and cemented mobile‑first, accessibility‑driven design as a baseline for future initiatives. It also increased adoption of the design system across flows and improved alignment with Product and Engineering around priorities, flow logic, and scalability.

What I learned

Designing for small business merchants highlighted how different B2B needs are from B2C: flows must be as quick as consumer experiences but offer enough control and visibility to run a business. It also reinforced that regulatory alignment is not an optional but an extra core driver of trust and adoption in fintech.

Leading this work underscored the value of clear communication, shared rituals, and defined success metrics in keeping product, engineering, and operations moving in the same direction. Finally, designing for non‑technical users proved that reducing cognitive load, providing immediate feedback, and preventing errors are the fastest ways to build confidence with new digital payment tools.